Financial Planning Guide For New Parents Over 30

Financial Planning for Expecting Parents

Your Ultimate Guide to Financial Stability

Congratulations, future parents!

You're about to embark on an incredible journey of parenthood. While you're preparing for your little one's arrival, it's crucial to ensure your financial house is in order. This comprehensive guide is your trusty companion, helping you navigate the financial aspects of parenthood with confidence and ease. Let's get organized and secure your family's financial future!

Budgeting for Baby Expenses:

Setting the Foundation for Financial Success

Celebrate Your Financial Preparedness! 🎉

Take a moment to appreciate your proactive approach to financial planning

Initial Costs: Nesting with Purpose

- Create a cozy nursery without breaking the bank

- Invest in essential baby gear (make it a fun shopping adventure!)

- Plan for medical expenses (remember, every prenatal visit is a chance to connect with your baby)

Ongoing Costs: Embracing the Journey

- Budget for diapers and formula (pro tip: bulk buying can be a game-changer!)

- Plan for adorable baby outfits (they grow so fast!)

- Research childcare options that fit your family's needs and budget

Budget Templates: Your Financial Roadmap

- Explore sample budgets tailored for new parents

- Customize templates to fit your unique family situation (make it a bonding activity with your partner!)

Insurance and Benefits: Protecting Your Growing Family

- Health Insurance: Covering Your Precious Cargo

- Review your coverage for prenatal care and delivery

- Ensure your policy includes newborn care (every check-up is a celebration of your baby's growth!)

Life Insurance: Securing Your Family's Future

- Explore options that provide peace of mind

- Consider policies that grow with your family

Employer Benefits: Maximizing Your Workplace Perks

- Investigate maternity/paternity leave options (more time to bond with your little one!)

- Take advantage of flexible spending accounts for healthcare costs

- Savings and Investments: Building a Bright Future

Emergency Fund: Your Financial Safety Net

- Start or boost your emergency savings (aim for 3-6 months of expenses)

- Treat saving as a fun challenge – every dollar counts!

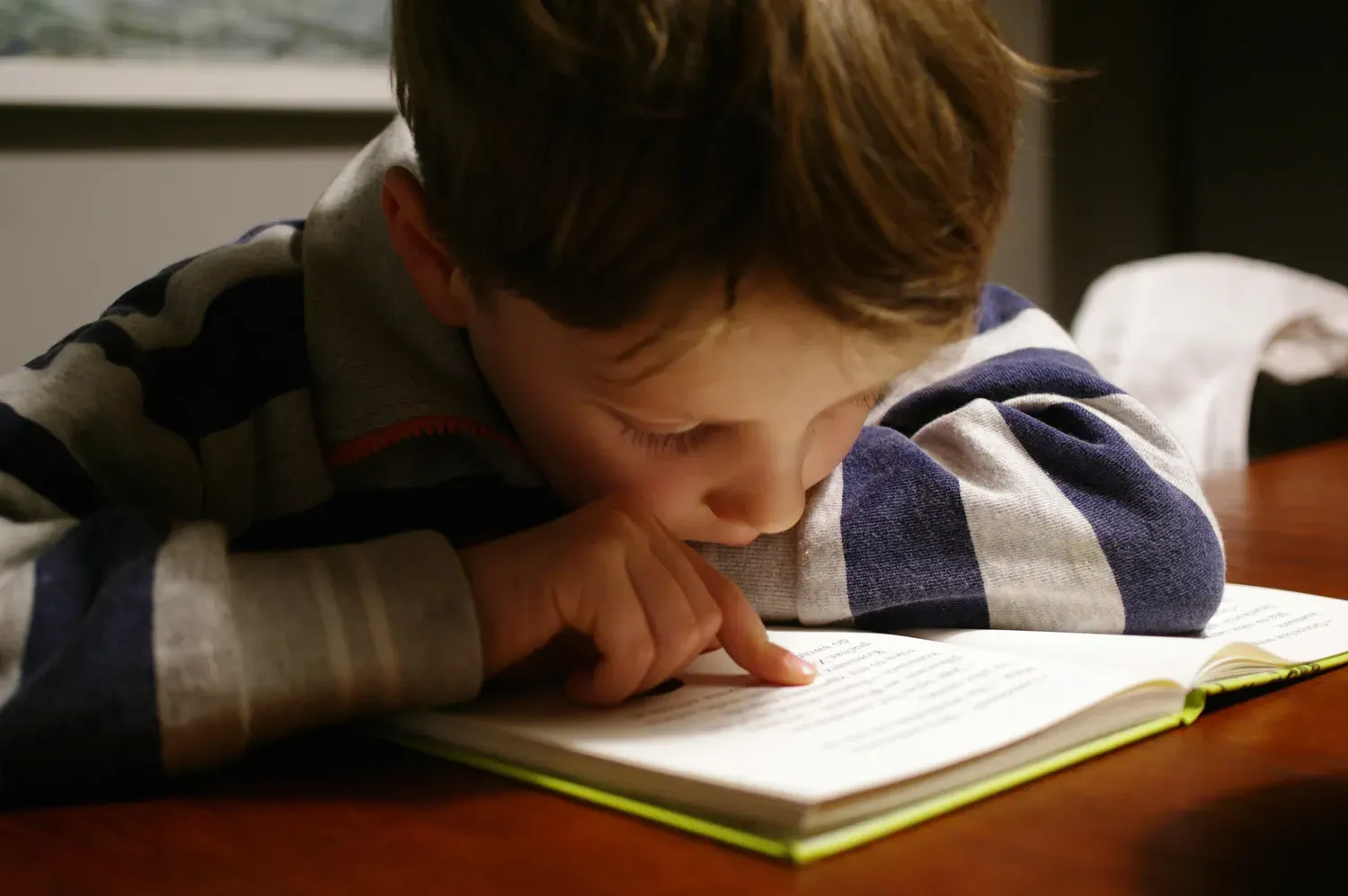

- Education Savings: Dreaming Big for Your Little One

- Explore college savings plans (it's never too early to start!)

- Consider opening a 529 plan or other education-focused accounts

Long-Term Investments: Securing Your Family's Tomorrow

- Review your retirement planning strategy

- Explore investment options that align with your family goals

- Debt Management: Clearing the Path to Financial Freedom

- Assessing Current Debt: Taking Stock with Confidence

- Evaluate existing debts and their impact on your family budget

- Create a clear picture of your financial landscape

Payoff Strategies: Conquering Debt with Determination

- Explore methods like the snowball or avalanche approach

- Celebrate each debt milestone – you're securing your family's future!

- Debt Consolidation: Simplifying Your Financial Life

- Consider options to streamline your debt repayment

- Consult with financial advisors to find the best solution for your family

Financial Planning Tools: Your Digital Financial Assistants

- Budgeting Apps: Technology at Your Fingertips

- Discover apps that make managing finances a breeze

- Find tools that help you track expenses and stay on budget

Savings Calculators: Visualizing Your Financial Goals

- Use online calculators to estimate savings needs and set achievable targets

- Make saving a fun family activity – watch your nest egg grow!

Financial Planners: Expert Guidance for Your Journey

- Learn when and how to seek professional financial advice

- Find a planner who understands the unique needs of growing families

Throughout Your Financial Planning Journey:

- Stay Informed and Proactive

- Keep up with financial news relevant to young families

- Regularly review and adjust your financial plan

- Communicate with Your Partner

- Have open discussions about financial goals and concerns

- Make financial decisions as a team

- Celebrate Financial Milestones

- First month sticking to your new budget

- Reaching savings goals for baby expenses

Remember, this guide is a roadmap, not a rigid set of rules.

Every family's financial journey is unique, so feel free to adapt it to your specific needs and circumstances. The most important aspects are to stay positive, work together, and keep your growing family's best interests at heart.

As you tick off each financial task, take a moment to appreciate the secure future you're building for your little one. You're not just managing money; you're creating a foundation of stability and opportunity for your family.

Here's to your financial success and the amazing family you're nurturing. You've got this, future parents!

🎉 Congratulations on taking this important step towards financial stability! 🌟

This financial planning guide is your ultimate resource for navigating the financial aspects of parenthood with confidence and joy. From budgeting basics to long-term investment strategies, we've got you covered!

Here's what makes this guide AWESOME:

💰 It's packed with practical advice and encouragement at every step

🏆 It covers all the financial essentials while keeping the focus on your growing family

💖 It includes reminders to celebrate your financial victories, big and small

🎨 It encourages you to personalize your financial plan to fit your unique family needs

🌟 It emphasizes the importance of teamwork in financial planning

Remember, you're not just crunching numbers - you're building a secure and bright future for your family. Embrace the process, work together, and get ready for a lifetime of financial confidence and family adventures!

Let the smart financial planning begin! 🚀👶💕

Citations:

[1] https://www.canada.ca/en/revenue-agency/services/forms-publications/publications/t4114/canada-child-benefit.html

[2] https://en.wikipedia.org/wiki/Canada_Child_Benefit

[3] https://support.hrblock.ca/en-ca/Content/Parent_Dependants/CanadaChildBenefit.htm

[4] https://www.canadalife.com/blog/investing-saving/five-financial-steps-help-new-parents.html

[5] https://moneymentors.ca/money-tips/how-to-financially-plan-for-a-baby/

[6] https://www.sunlife.ca/en/tools-and-resources/money-and-finances/managing-your-money/how-to-prepare-your-finances-for-maternity-leave/

[7] https://www.cooperators.ca/en/resource-centre/plan-ahead/having-a-baby

[8] https://www.manulife.ca/personal/plan-and-learn/life-events/raising-a-family/five-steps-to-financial-readiness-for-new-parents.html